Cash Flow (CF) is an increase or decrease in the amount of money a business, organization, or individual has. In finance, the term Cash Flow is used to describe the amount of cash (currency) created or consumed in a given period of time. Indeed, more than a third of SMEs consider cash flow problems a barrier to their growth. Let's find out with Giaiphapdonggoi.net what is Cash Flow? Please!

Table of Contents [Hide]

1. What is Cash Flow?

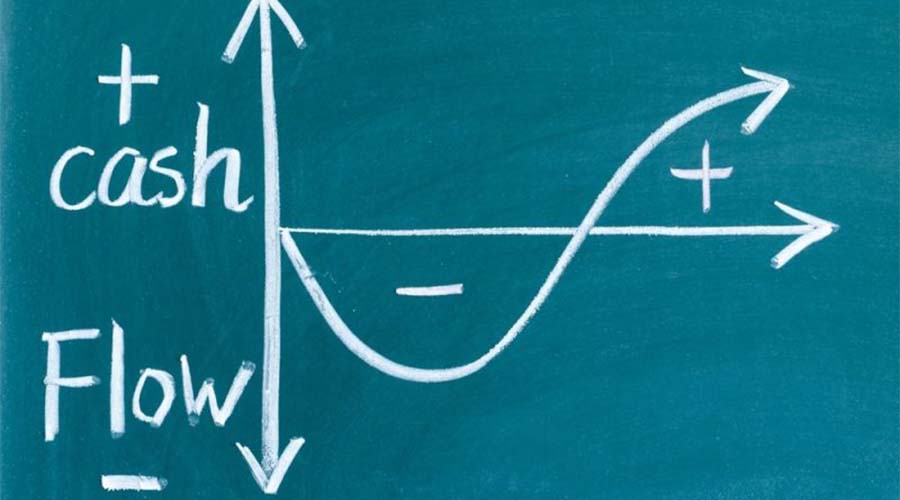

Cash Flow - cash flow refers to the movement of money in and out of your business according to income and expenditure. Ideally, you want a positive cash flow - meaning the business is pouring more money in than going out. If you have a positive cash flow, your business will be able to pay its bills and invest in growth. Negative cash flow means you will need to find an alternative source of income to be able to pay off your debts.

What is Cash Flow?

If you want to calculate net cash flow, you simply add up all your cash payments for a certain period (usually a month) and take that number out of your cash receipts. However, it's important not to get too hung up on a particular month. Your Cash Flow can be more accurately assessed over a period of three months or more as most businesses will naturally have peaks and troughs.

While your revenue can be a big number that gives you confidence that your business is doing well, it is cash flow that provides insight into how well the business is managed. As the saying goes - revenue is vanity, profit is sanity and cash flow is real.

2. What happens if you don't update your Cash Flow?

Failure to properly monitor and manage your Cash Flow puts your business at risk and can lead to a host of different problems. Here are some of the main problems you may encounter:

What happens if you don't update your Cash Flow?

Too much stock: If you suddenly get a high demand for a product, you'll want to order a large volume of material to serve that demand. However, if that demand then changes, you could be left with too much inventory and potentially go into debt from ordering materials. Over-ordering can also leave you inundated with materials that are outdated and hard to sell.

Long payment terms: Long payment terms can often cost you a lot of time when you don't have money. Any invisible problem, from an office fire to a laptop replacement, can then be a cash shortage problem while you wait for the money. arrive. There is also the possibility of bad debt, which is when the customer does not pay.

Overspending: It's tempting to spend when you win a new client - buying everything from plush orthopedic chairs to office ping pong tables. However, you need to remember that you don't actually get the money until they pay you. Spending money you don't have is never the best idea.

Overtrading: Just like stocks, it's easy to understand your trading prospects after a large order is placed. Hiring more employees or expanding to more locations may seem like a good idea to grow your business, but you need cash flow to support this. While your profits may vary, your rent and salary will not, which means you need to withstand short-term financial pressure if you want to grow your staff and facility.

3. Cash Flow Statement

Given the importance of good cash flow management, it can be helpful to produce a report that demonstrates this. The cash flow statement looks a lot like the profit and loss statement and balance sheet. It should aim to look at how cash moves in and out of the business. This, in turn, allows you to:

Statements of cash flows

Consider how money moves through the business

What impact does cash flow have on the business?

How to pay with balance and cash value

In essence, you should think of the cash statement as a condensed version of the balance sheet that you prepare once a year. The final result of your statement should be the “Net Cash” number, which is the final number calculated from all the other numbers on your statement.

What to put on your cash flow statement?

The cash flow statement should be made up of three categories: operating, investing, and financial.

Activity: This is your net income, plus or minus increases or decreases in your current assets and liabilities and expenses.

Investments: This number reflects any increase or decrease in long-term or fixed assets (regardless of accumulated depreciation).

next).

Financing: This reflects any increase or decrease in long-term liabilities/liabilities, equity or dividends.

Once you have these three metrics, you can add or subtract them from your initial cash balance to get your overall net cash balance.

Why prepare a cash flow statement?

In addition to giving a summary of how much cash is available for operations, the cash flow statement also details the ways in which the business is generating revenue. In turn, this reveals a lot about how (or, if) growth is happening, i.e. whether it is through increasing debt, income, etc. This kind of information is very important if you want to. can be planned in advance. You may even want to make a forecast, based on how you think the changes you're making to the business will be reflected in a future cash flow statement.

This statement is a way of ensuring that you will be able to pay all your bills. As a startup, it can tell when you need an alternative source of financing when you find your footing. While seasonal businesses can use this feature to keep track of what happens during peak seasons and quieter times.

4. Difference between Cash Flow vs Profit

Difference between Cash Flow vs Profit

Cash flow and profitability are both important financial metrics in business, and it's not uncommon for those new to the worlds of finance and accounting to sometimes confuse the two terms. But cash flow and profit are not the same, and it is important to understand the difference between them to make important decisions regarding the operating performance and financial health of a business.

For investors, understanding the difference between profitability and cash flow can make it easier to tell if a profitable company is actually a good investment based on its ability to stay solvent in the future. period of economic crisis. For entrepreneurs and business owners, understanding the relationship between the terms can inform important business decisions, including how best to pursue growth.

The basic difference between cash flow and profit is that while profit indicates the amount of money remaining after all expenses have been paid, cash flow indicates the net flow of cash in and out of a business.

Investors and business owners are often looking for a single metric so they can understand the performance of a company. They want to know a number they should look at to determine whether they should invest or pivot their business strategy. Cash flow and profitability, two important and related financial metrics, often compete with each other: Which is more important?

There is no simple answer to that question; both profitability and cash flow are important in their own right. As an investor, business owner, key employee, or entrepreneur, you need to understand both metrics and how they interact if you want to gauge the financial health of a business.

For example, a company can be both profitable and have negative cash flow that hinders the company's ability to pay expenses, expand, and grow. Likewise, a company with positive cash flow and growing sales will not be able to make a profit, as is the case with many startups and scalers.

Profit and cash flow are just two of the dozens of financial terms, metrics, and ratios you should familiarize yourself with to make informed decisions about a business. By thoroughly understanding key financial principles, you can advance professionally and become a smarter investor or business owner.

Thus, Giaiphapdonggoi.net has brought you all the most important information about what Cash flow is and some ways to improve it effectively. Be a smart person when equipping yourself with more useful knowledge for more sustainable business development. Good luck!

See more articles on the same topic:

- What is Sales Supervisor? The difference between Sales Manager and Sales Supervisor positions

- Frequently asked job interview questions and how to answer them

Please see more packaged products at PACKING SOLUTION!!!

- PP belt

- Pet belts

- Battery-powered hand strapping machine