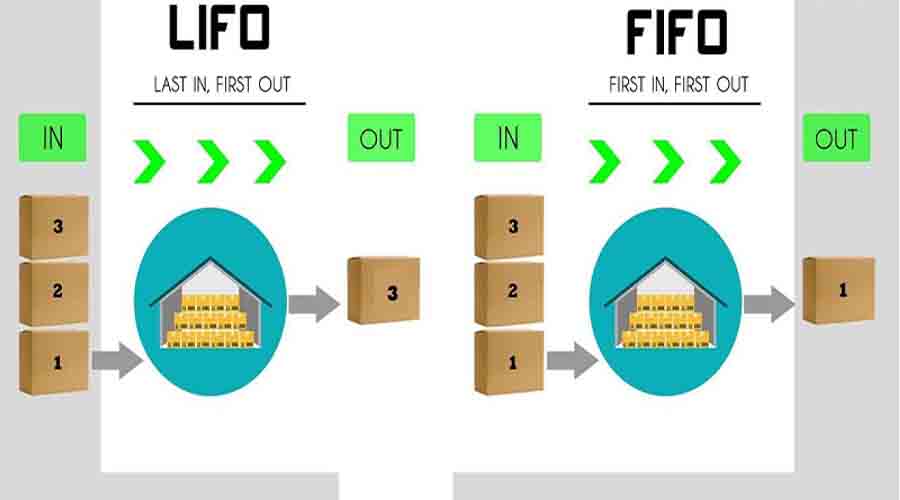

FIFO and LIFO are methods used to calculate cost of goods sold. FIFO (“First In, First Out”) assumes that the oldest products in a company's inventory are sold first and follows those costs of production. The LIFO ("Last In, First Out") method assumes that the most recent products in a company's inventory are sold first and uses those costs instead. Let's join Giaiphapdonggoi.net to find out what FIFO is? What is LIFO? Please!

Table of Contents [Hide]

1. What is FIFO?

What is FIFO?

FIFO stands for "first in, first out". This is an accounting method used when calculating cost of goods sold (COGS). As the name suggests, FIFO works on the assumption that the oldest products are sold first. It helps to calculate the cost of goods line, with the oldest product costs used first in the cost of goods sold calculation.

When calculating taxes, FIFO assumes that the oldest costing asset is the one included in the cost of goods sold of the income statement. Any remaining assets will be matched with those most recently purchased.

2. What is LIFO?

What is LIFO?

LIFO stands for “Last in, first out” is a method used for inventory accounting that records the most recently manufactured items as sold first. Under LIFO, the cost of the most recently purchased (or manufactured) products is included in the cost of goods sold (COGS), which means the lower cost of older products will be reported as inventory. warehouse.

3. What is the difference between FIFO and LIFO?

What is the difference between FIFO and LIFO?

The method a company uses to assess their inventory costs will affect their bottom line. The amount of profit a company claims will directly affect their income taxes.

Inventories refer to goods purchased with the intention of reselling or manufactured goods (including labor, raw materials, and manufacturing overhead). FIFO and LIFO are just assumptions. These methods are not really linked to actual inventory tracking, just total inventory. This means that a company using the FIFO method can offload inventory purchased more recently than before, or vice versa, with LIFO. However, for the cost of goods sold (COGS) to work, both methods must assume inventory is being sold to their expected orders.

>> Let's consult about plasticized belt products in Dong Nai

4. Which method is better than FIFO or LIFO?

Which method is better than FIFO or LIFO?

FIFO is considered a more transparent and reliable cost of goods sold method than LIFO. Here's why. In essence, the “first in, first out” method is easier to understand and implement. Most businesses offload the oldest products anyway - as older inventory can become obsolete and depreciate. As such, FIFO only follows that natural inventory flow, which means there is less chance of errors when it comes to bookkeeping. LIFO allows a business to use the most recent cost of inventory first. These costs are often higher than it used to be to manufacture or purchase older inventory. Thus, the profit is lower. While this may mean a company has to pay less tax under LIFO, it also means that profits reported with FIFO are much more accurate because older inventory reflects the actual cost of the company. that inventory. If the natural return is high under FIFO, then the company will become much more attractive to investors. The problem with a company switching to the LIFO method is that older inventory can stay on the books forever and older inventory (if not perishable or obsolete) will not reflect market value. current school. It will be reduced. Finally, according to LIFO, financial statements are much more susceptible to manipulation. This is considered best practice for using FIFO. Financial statements are much easier to manipulate. This is considered best practice for using FIFO. Financial statements are much easier to manipulate. This is considered best practice for using FIFO.

5. How do you calculate FIFO and LIFO?

How do you calculate FIFO and LIFO?

To calculate COGS (Cost of Goods Sold) using the FIFO method, determine the cost of your oldest inventory. Multiply that cost by the amount of inventory sold. To calculate COGS (Cost of Goods Sold) using the LIFO method, determine the cost of your most recent inventory. Multiply that cost by the amount of inventory sold. The price a company pays for its inventory often fluctuates. These variable costs must be taken into account regardless of which method the business uses. Ultimately, the product needs to be sold to be used in the equation. A company cannot use unsold inventory to calculate cost.

both ways

Both FIFO and LIFO methods have their own special features and points. Therefore, in production activities, it is necessary to clearly understand the management object. Apply appropriate management methods.

Check out more articles on the same topic:

- What is email marketing? Advantages and disadvantages of Email Marketing

- What is E-commerce, advantages and disadvantages of e-commerce and its types